Predicting Trend Reversals with Candlestick Patterns for Beginners

Tan Kean Soon, Assistant Manager, CFD Dealing

Kean Soon graduated from the National University of Singapore with a Bachelor’s degree in Materials Engineering. He is a passionate CFD dealer who believes that equity markets can help grow one’s wealth with the right mindset, risk management and investing discipline.

In his free time, he enjoys educating himself on long-term investments and short-term trading as well as keeping up with the latest market news.

Candlestick patterns are used to predict the future direction of price movements as they contain insights into market sentiment and potential price changes. Prior to using a candlestick chart, traders need to determine the duration for which they intend to hold a particular position (e.g., intraday, days, weeks, months) before choosing the appropriate period for technical analysis. In the event where traders wish to take advantage of a bearish market sentiment, traders can consider to trade on Contracts for Differences (CFDs), which is a financial instrument that allows traders to initiate short positions on stock or indices with ease. In this article, we will discuss methods to predict price trend reversals with common candlestick patterns, with each candlestick representing a trading day.

What are candlesticks?

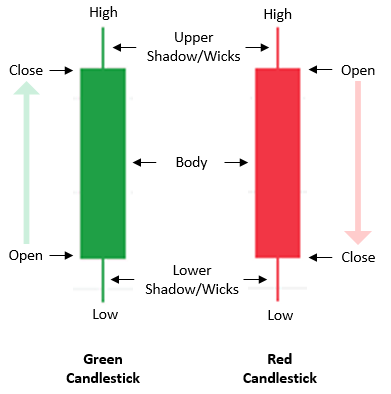

The figure on the left shows an example of candlesticks.

Each candlestick has three basic features:

a) The body, which represents the price range between the open and close

b) The shadow, or wick, which indicates the price range between the high and low

c) The colour, which reveals the direction of price movement. A green body indicates a price increase, while a red body shows a price decrease.

As the market trading session continues, individual candlesticks form patterns on a chart that traders can use to determine possible trading opportunities. Some patterns provide insights into market buying and selling pressures, while others identify continuation patterns or market indecision.

The sections below explore some of the common candlestick patterns that traders use to predict trend reversals.

Common candlestick patterns for predicting trend reversals

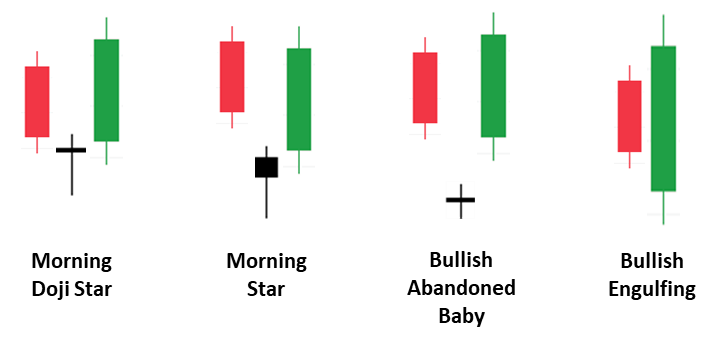

1) Bullish Reversal

Some of the commonly used patterns in predicting bullish reversal include Morning Doji Star or Doji Star, Bullish Abandoned Baby and Bullish Engulfing, as shown below.

A Morning Doji Star / Morning Star pattern is typically identified by three consecutive candles near the end of a downward trend with a unique arrangement. For starters, a Doji is formed when the open and close price of a candlestick are equal, or very close to equal, and as a result it resembles a ‘†‘ (cross) shape. The sequence begins with a tall red candle, followed by a doji or a small-bodied candle that gaps below the previous candle’s body. This small-bodied candle can be either red or green. Subsequently, the third candle is a tall green candle positioned above the body of the doji or small-bodied candle, signalling a potential reversal.

As for the Bullish Abandoned Baby pattern, it looks similar to the Morning Doji Star or Morning Star pattern, except that the middle candle is a doji whose shadow does not overlap with the shadow of the tall red candle from the previous day and the tall green candle from the following day. As a result, the doji appears to be “abandoned” by the surrounding candles on the price chart. The sequence starts with a red candle indicating a price drop, followed by a doji that gaps below the first red candle. This doji indicates that buying and selling pressures are nearly balanced, as the opening and closing prices are similar. A subsequent green candle that gaps above the doji suggests building buying pressure and a likely bullish reversal.

The Bullish Engulfing pattern consists of two candle lines near the end of a downward trend, where the first candle is red, and the second is green. The main criteria to identify the engulfing is that the green candle’s body must overlap or “engulf” the entire red candle’s body. The shadows of both candles can be ignored in this analysis.

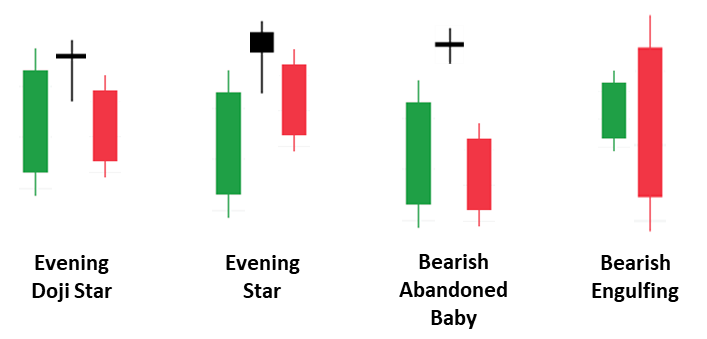

2) Bearish Reversal

As for predicting bearish reversal or downward breakouts after an uptrend, commonly used patterns are Evening Doji Star or Evening Star, Bearish Abandoned Baby and Bearish Engulfing, as shown below.

As opposed to Morning Doji Star/Morning Star, an Evening Doji Star / Evening Star pattern is typically characterised by three consecutive candles near the end of an uptrend, arranged in a specific sequence. The sequence begins with a tall green candle, followed by a doji or a small-bodied candle whose body gaps above the previous candle’s body. The small-bodied candle can be either red or green. Subsequently, the third candle is a tall red candle whose body remains below the second doji’s or small-bodied candle’s body.

As for the Bearish Abandoned Baby pattern, it looks similar to Evening Doji Star or Evening Star pattern, except the middle candle is a doji whose shadow does not overlap with the shadow of the preceding tall green candle and the subsequent tall red candle.

As a result, the doji appears to be “abandoned” by the surrounding candles on the price chart.

The pattern starts with a green candle indicating a market rally, followed by a doji that gaps above the first green candle, reflecting balanced buying and selling pressures. A subsequent red candle that gaps below the doji suggests building selling pressure and a likely bearish reversal.

The Bearish Engulfing pattern consists of two candle lines near the end of an uptrend, where the first candle is green and the second is red. The key characteristic of this pattern is that the body of the red candle must overlap or “engulf” the entire body of the green candle. The shadows of both candles can be ignored here.

Live examples with candlestick patterns

The chart below demonstrates how traders can identify potential trading opportunities by utilising the candlesticks patterns discussed earlier.

Example: Daily Price Chart of Fiserv (NYSE: FI) over the past year

After Morning Doji Star appeared at the end of the first downtrend channel on29 May 2023, a reversed uptrend channel was developed. Traders might consider entering a long position 1-2 days after the appearance of the Morning Doji Star to ride on the uptrend.

Subsequently, the appearance of a Bearish Engulfing pattern on 24 July 2023 indicates the start of a reversed downtrend, a good indication that traders could consider initiating a short position 1-2 days later after this pattern to ride on the downtrend.

Following this, a Morning Star pattern appeared in mid-Oct 2023, indicating the beginning of a reversed uptrend channel, where traders may choose to enter a long position 1-2 days after the appearance of this pattern.

In this scenario, traders might consider opening a long position 1-2 days after observing a Bullish Engulfing pattern around mid-July 2023 to ride on a reversal into an uptrend.

Candlestick patterns provide insights into potential price actions, but it’s crucial to remember they are not definitive predictors. While patterns like the Bullish Engulfing may suggest a reversal, the actual price trend may not always shift as expected. Historical data indicates that the candlestick patterns discussed earlier have success rates between 60% and 80% in predicting price reversals [1]. In addition, key news events such as earnings release, FOMC meeting and macro-economic news can disrupt trading signals. As such, traders are advised to analyse the broader market context and key news events before committing any trading decisions and implement appropriate stop loss strategies to mitigate potential losses.

Conclusion

Candlestick patterns, such as the Morning Doji Star, Bullish Abandoned Baby, and Bullish Engulfing, suggest potential bullish reversals and could warrant a long position a few days after they form. Conversely, their bearish counterparts like the Evening Doji Star, Bearish Abandoned Baby, and Bearish Engulfing suggest possible short positions.

Despite their utility, the effectiveness of these patterns is not absolute, with success rates highlighting the probabilistic nature of these tools. Traders can consider using Contracts for Differences (CFDs) to initiate short positions on stock or indices with ease to take advantage of negative market sentiments. Traders are encouraged to consider broader market contexts and implement protective measures like stop-loss strategies to safeguard investments.

How to get started with POEMS

POEMS’ award-winning suite of trading platforms offers investors and traders more than 40,000 financial products across global exchanges.

Trade Smarter and Faster

With our newly launched POEMS Mobile 3 Trading App

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

For enquiries, please email us at cfd@phillip.com.sg.

References

[1] Encyclopedia of Candlestick Charts by Thomas N. Bulkowski, Chapter 2 – Statistics Summary.

More Articles

Playing Defence: Diversification in Forex Trading

Learn how strategic planning and risk management can help you navigate the highs and lows of the forex market. Don’t miss out on unlocking the secrets to long-term profitability!

From Boom to Bust: Lessons from the Barings Bank Collapse

Did you know that the collapse of Barings Bank in 1995 was from massive losses incurred by a rogue trader? Delve into the tale of how Nick Leeson’s fraudulent investments sent shockwaves through the financial world.

Japan's Economic Resurgence – Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Discover the driving forces behind Japan’s market surge, delve into its economic performance and learn how CFD products can help you navigate the Japanese market’s volatility via our article!

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.