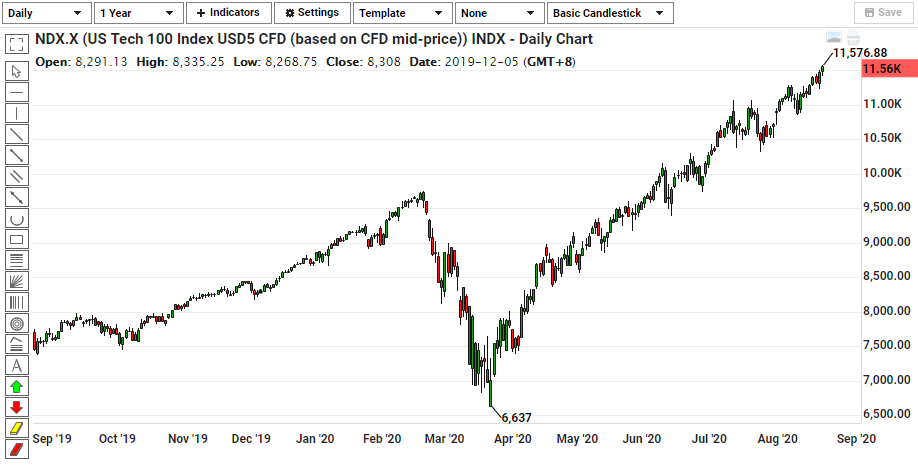

Technical Analysis: NDX in a Strong Uptrend

Published On: 24 August 2020Jeraldine Tan, Senior Dealer

- Nasdaq has been on an uptrend since the low in Mar-Apr, as hot money got shifted from traditional businesses into Tech focused businesses. This was largely due to the perceived resilience of tech businesses over traditional businesses in this covid-19 environment where traditional businesses take a hit from lack of physical demand (which has since shifted to online platforms). We saw Nasdaq diverging from S&P500, both of which have been closely related historically.

- In July, Nasdaq went into a range which but it has since broken out and continued the uptrend. Bulls may consider following the trend, buying pullbacks with stops below the July range. With such strong buying pressure, bears may want to sit on the side-lines until a mini double top has been formed before considering a short position.

- A key point to consider is whether this is a bubble and whether the Nasdaq-S&P500 relationship will revert to post covid-19 levels. In light of this potential risk, bulls may want to manage risk by sizing their positions relative to their wide stops such that the percentage of equity risked is manageable per entry.

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.