Made in Singapore: 2 Stocks to Watch This National Day

Jeremy Chua, Dealing

Jeremy graduated from Nanyang Technological University with a Bachelor’s Degree in Business and is a member of the largest dealing team in Phillip Securities. He strongly believes in the importance of staying invested in the financial markets and evaluates stocks using fundamentals to make informed investment decisions.

In his free time, he enjoys researching on market events and disruptive investment themes to generate new investment ideas for the short and long term.

As Singapore celebrates its 58th birthday, we highlight two home-grown companies that are worth watching this National Day. With about 650 companies listed on the SGX, I have devised a way to screen out stocks and narrow down the number of companies that investors like you can look at.

I use my screening process which is simple and easy to implement to find:

-

- Good companies

- Undervalued companies

Firstly, I would define a good company as one with High Return on Equity (ROE) because the primary purpose of businesses and companies is to maximise the returns of the shareholders. ROE provides insights regarding a business’s profitability for both owners and investors. It helps investors understand whether they’re getting a good return on their money, and evaluate how efficient the company is at utilising its equity. It only makes sense to buy stocks of companies that can make the most profit for their shareholders!

The formula for calculating ROE is:

Secondly, I would then define an undervalued company as one with high earning yields. As shared by Benjamin Graham (also known as the “father of value investing”): “ ‘Mr Market’ tends to be irrational in the short term, but in the long run, he actually values stocks close to their true value. There are times to exploit Mr Market’s unstable emotions; that is, to buy from him when he is depressed about stocks. In this way, you can buy the best companies at a low price.

One way to do this is to purchase a business that earns more relative to the price you are paying rather than less, and one metric you can use to measure this is the business’ earning yield.

Earning Yields is essentially the same as Earning Per Share (EPS). It is also the inverse of the P/E ratio.

The formula for calculating Earning Yields is as follows:

Enterprise Value= Market value of equity + net interest-bearing debt

The Screening Process

In order to rank the SGX-listed companies based on the above two factors, I will be using the stock screener provided on the SGX website, known as SGX StockFacts, a collaboration between SGX and Refinitiv. [1]

To screen for stocks with high Earnings Yield, I will be using the P/E ratio from the stock screener. Generally, the lower the ratio, the more undervalued a company stock is.

However, during this screening process, I noticed that a lot of penny stocks came up on the search list, possibly due to their high P/E ranking. Penny stocks in Singapore are traded in cents (less than 20 cents, to be specific). As such, I have added 2 more criteria to my screening process. The counter:

-

- has to be trading for more than S$0.50 and

- needs to have a market cap of at least S$10 million

While penny stocks tend to be highly volatile, they have very low liquidity (especially in the SGX market) and are prone to speculation, making them very risky counters to hold.

From the screening process, I derived a list of stocks which are of higher “quality”. I then go down the list, starting from the top ranked, to look at each of the counter’s past performances (minimum 5 years) as well as comments from analysts covering the counter before I conduct further analysis.

After all of the above-mentioned has been done, I managed to find 2 counters that we will now delve deeper into:

-

- SamuderaShipping (SGX: S56) with a ROE of 73.32% and a P/E ratio of 1.11

- Food Empire (SGX: F03) with a ROE of 23.83% and a P/E ratio of 7.72

Let’s understand these 2 companies better by doing some qualitative analysis on them to complement our quantitative based screening.

1. SamuderaShipping (SGX: S56)

Samudera Shipping Line Ltd is in the Industrials sector with a focus on Marine Transportation. The company is primarily engaged in the transportation of containerised and non-containerised cargo through its container shipping and bulk & tanker business segments. The Group’s vessels and services currently ply trade routes connecting various ports in Southeast Asia, the Indian Subcontinent, the Far East, and the Middle East. [2]

Past

Incorporated in 1993, Samudera has expanded from a container shipping provider into the bulk and tanker business and logistic business, covering services in SEA, the Indian subcontinent and Far East.

In the bulk and tanker business segment, Samudera provides shipping services for oil, chemical, gas, liquefied products, as well as dry bulk (unpackaged raw materials) across the region. Through its subsidiary, Samudera also offers such services within the Indonesian domestic market.

Samudera’s operating fleet, which comprises vessels owned and leased by the Group, currently stands at 32 (as of 28 February 2023), comprising 27 container vessels, 4 chemical tankers and 1 gas tanker. [3]

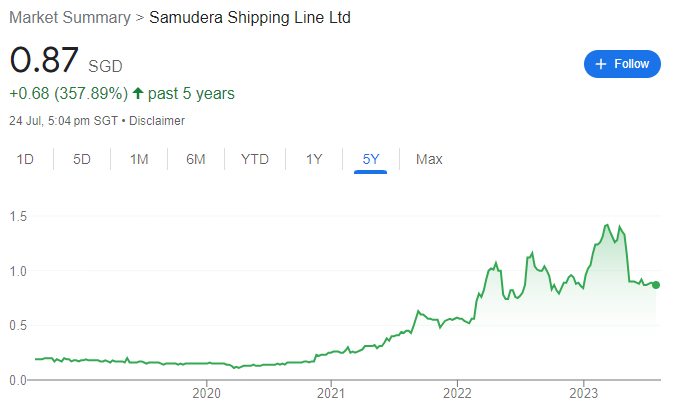

The company was listed on the SGX Main Board in July 2000. For the past five years, the stock has delivered a whopping ~357% in returns for its shareholders.

The company has benefited from the logistic squeeze in 2021. This was the period where share price appreciation happened at an elevated pace.

Present

For FY 2022, Samudera recorded an 88% increase in revenue to US$990.6 million year on year (YoY), as a result of improvements in demand and strong freight rates across all business segments, primarily container shipping. [3] While freight rates softened in the second half of the year, average rates for the full year were significantly higher on a YoY basis as demand for shipping services outpaced supply.

As at 24 July 2023, the YTD performance currently stands at 2.35%. The weak performance was mainly attributed by the 20% drop in share price back on 28 April when the company issued a profit guidance, reporting contraction in its Q1 earnings due to softening of freight rates and a decline in container volume handled as compared to the same period last year.

Outlook

Moving forward, while freight rates will taper to a new normal, Samudera has timed the ins and outs of its fleet to achieve a younger and more efficient fleet in 2023 and better manage its charter costs. In addition, it targets to expand its service network as countries like China lift border restrictions.

Secondly, PT Samudera Shipping Indonesia, which provides sea transportation for bulk shipping and other maritime projects, will hopefully be a revenue driver in the medium term as bulk and tanker freight rates have remained strong. The management’s fleet expansion with 2 chemical tankers in FY22 reflects confidence in its outlook.

Thirdly, we can also expect Samudera’s newly-acquired subsidiary to contribute. Samudera’s agency & logistics revenue increased by 56.8% YoY to US$18.5m in 2022 after its acquisition of a 50% stake in Indonesia-based third-party logistics company, PT Samudera Logistics in April 22. 2023 will be the first full-year contribution from the new acquisition.

Fourthly, the shipping industry is highly cyclical which is apparent in the stock prices. For years, there has been a cycle of low investment leading to higher freight rates, that creates a boom of ship building, followed by rates crash and investment stops, that repeats itself. One of the main factors fueling this cycle is the low costs of entry into the business. Spending a few millions will enable a new entrant to easily enter the market and capture the high shipping rates. So, supply expands massively when shipping prices are high. This tends to lead to oversupply and crashing prices, driving out weaker players out of the market, restarting the cycle. That being said, looking at the current share price of Samudera Shipping, this could be a possible inflection point and a good opportunity to enter a position for this counter.

The last six months have been tough on Samudera Shipping shareholders, who have seen the share price decline by a rather worrying 20%. However, if we zoom out and look at the bigger picture over a longer timeframe, the share price has delivered a strong performance of about 360% returns in the past 5 years. That being said, share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and its EPS.

During the 5 years of share price growth, the EPS grew at an average annual rate of about 360%, much higher than its share price which grew at an average rate of about 72%. Therefore, it seems that the market has moderated its expectations for growth and this cautious sentiment is also reflected in its relatively low P/E ratio of 1.11.

To add on, belief in the company remains high for insiders as there hasn’t been a single share sold by the management or company board members (as of 6 July 2023). But more importantly, Group CEO & Executive Director Bani Mulia spent US$220k acquiring shares, at an average price of US$0.97. [5] Strong buying like that could be a sign of opportunity.

All in all, with the stock having performed exceptionally well over the last five years, investors have begun taking these patterns into account. Hence it’s worth researching the company further to see if these trends persist.

2. Food Empire (SGX: F03)

Food Empire Holdings Ltd (FEH) is a multinational company headquartered in Singapore in the Consumer Staples sector, focusing on manufacturing and distributing of Food and Beverage products. FEH’s products are sold in over 60 countries, spanning North Asia, Eastern Europe, South-East Asia, Central Asia, the Middle East, and North America. [6]

FEH’s branded products include a wide variety of beverages and snack food, such as regular and flavoured coffee mixes, flavoured fruit teas, bubble tea, instant cereal mixes and potato crisps. Their core product – instant coffee beverages – is marketed mainly under the MacCoffee, Klassno, CafeRite brands. Their product offerings are categorised under beverages, and ingredients. [6]

Past

Founded in 1993 and listed on the SGX in 2000, FEH has won numerous accolades and awards including being recognised as one of the “Most Valuable Singapore Brands” by IE Singapore (now known as Enterprise Singapore), while MacCoffee has been ranked as one of “The Strongest Singapore Brands”. Forbes Magazine has twice named FEH as one of the “Best under a Billion” companies in Asia, and the company has also been awarded as one of Asia’s “Top Brands” by Influential Brands. [6]

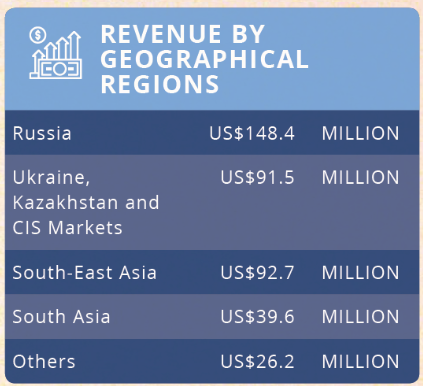

Their revenue comes from three main regions namely Russia, Ukraine, Kazakhstan and CIS Markets, and South-East Asia. Below is their FY22 revenue categorised by these geographical regions:

For the past year, the stock has delivered a strong performance of 129%.

Present

In FY22, despite the geopolitical tensions in its core markets (such as Russia and Ukraine) as well as rising inflation, the group managed to generate record-level profits. FEH reported a net profit of US$ 60.1m for 2022, a 211% increase YoY. While its revenue grew by 24.5% YoY to US$398.4m. [7]

Russia reported a revenue growth of 29.1% to S$148.4m, mainly due to strong consumer demand, the appreciation of the Russian ruble against the US dollar, and higher Average Selling Price (ASP). Similarly, despite fluctuating currencies from geopolitical uncertainties, its Ukraine, Kazakhstan and Commonwealth of Independent States (CIS) segments achieved a 28.6% YoY revenue growth. [7]

However, revenue from the Southeast Asia segment fell 4.2% to US$92.7m, attributable to the post-pandemic normalisation in Vietnam, but partially offset by improved contributions from Malaysia’s non-dairy creamer and snacks manufacturing facilities. [7]

Additionally, the group was once again recognised as the Top 100 “Most Valuable Singaporean Brands” by Brand Finance, for the twelfth consecutive year. Its estimated brand value had increased 17% YoY to US$101m, a strong testament to its strong brand equity.

In May 2023, FEH also reported a net profit of US$13.8m (+50.9% YoY) for 1Q23, accounting for 29% of our full-year forecast, while its revenue rose 24.2% YoY to S$102.6m. [9]

From its FY22 and 1Q23 results, we can see that the level of demand remains strong for FEH’s products despite inflationary pressures as well as the geopolitical uncertainties in its core markets (Russia and Ukraine). This could be mainly due to the consumer-staple nature of its products where demand is relatively price inelastic. For instance, the group’s products in the coffee segment continue to be affordable enough for mass appeal and is also considered an essential item that was not placed under sanctions. This has led to sustainable or even stronger demand as proven by FEH’s consistent results.

Another thing to note is that the company has been ramping up its share buybacks over the past three years as the company’s financial performance improved. As of the 13 April market close, the company has brought back 16.98 million shares. [10] This reflects the management’s view that the shares are undervalued relative to the company’s performance and has potential for growth. The share price is currently trading at about 7.7x its earnings as compared to other listed beverage companies that make instant coffee, such as Nestle, Mondelez International, Starbucks Corporation, Kraft Heinz Company and Tata Consumer Products. They all trade above 20 times earnings.

Outlook

I believe that its strong performance should likely persist through the strong demand in its core CIS markets, especially in Russia. As shared earlier, demand is relatively price inelastic and the cost of raw materials, trade and logistics from higher inflation can be easily passed on to consumers. Furthermore, the geopolitical uncertainties in its core markets would have little impact on its core products offerings as they are unlikely to be placed under sanctions.

In addition, the management’s focus on expanding in Vietnam, to diversify beyond its core markets such as Russia and Ukraine, has shown positive signs in terms of traction.

FEH is also ramping up new capacity in South-east Asia to support greater production of its new potato chip brand, Kracks. The expansion of a facility to manufacture non-dairy creamer will begin commercial operations by the end of 2023.

Sales in its India market doubled in 2022. Its spray-dried and new freeze-dried coffee plants are expected to operate at full capacity in 2023, to capitalise on high demand.

The above mentioned are good brands and distribution channels which the company has built up since its diversification efforts in 2012. These channels should likely support the company’s expansion plan and subsequently its top line figures moving forward.

I believe that the FEH management would continue unlocking shareholder value by continuing its buybacks, concurring with my view that the shares are undervalued based on its relative P/E ratio.

Lastly, it is important to note that FEH has a competitive moat caused by the high barriers of entry into the industry and the sticky brand recognition the company has developed from its awards and accolades over the years.

Some price catalysts you can look out for in the near to mid term are the end of the Russia and Ukraine conflict as well as continued strong growth in other markets and revenue diversification away from Russia.

Concluding Thoughts

The SGX market still has plenty of strong and quality companies. You can repeat my screening process to select other companies based on your preference. If you have the time, you can even dive deeper into the above two companies for a better understanding. Ask questions about management quality, the share price drivers over the years (any red flags in the past), its competitors and so on. You can even include technical analysis to get a more comprehensive understanding of the counter.

I hope this article has been insightful and helpful in helping you screen and assess the potential of SGX stocks especially those with lesser news and analysts coverage that you can hold for the mid to long term.

How to get started with POEMS

As the pioneer of Singapore’s online trading, POEMS’s award-winning suite of trading platforms offers investors and traders more than 40,000 financial products across global exchanges.

Explore an array of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today. Find out more here (terms and conditions apply).

We hope that you have found value reading this article. If you do not have a POEMS account, you may visit here to open one with us today.

Lastly, investing in a community is much more fun. You will get to interact with us and other seasoned investors who are generous in sharing their experience and expertise.

In this community, you will be exposed to quality educational materials, stock analysis to help you apply the concepts, unwrap the mindset of seasoned investors, and even post questions.

We look forward to sharing more insights with you in our growing and enthusiastic Telegram community. Join us now!

For enquiries, please email us at cfd@phillip.com.sg.

Promotions

Earn up to S$360 cash credits when you trade FX CFDs!

From 3 July to 29 September 2023, enjoy up to S$120 cash credits every month and earn up to S$360 cash credits when you trade FX CFDs on POEMS for 3 consecutive months (July, August and September).

*T&Cs Apply.

For more information, click here.

References

[1]

https://investors.sgx.com/stock-screener

[2]

https://www.samudera.id/samuderashippinglineltd/en/5/aboutcompany

[3]

https://samudera.listedcompany.com/misc/ar2022/index.html

[4]

https://sg.finance.yahoo.com/quote/s56.si/

[5]

https://samudera.listedcompany.com/stock_insider.html

[6]

https://www.foodempire.com/about-us/

[7]

https://foodempire.listedcompany.com/newsroom/20230406_080406_F03_5WQFR9VVU0KC11HS.1.pdf

[8]

https://sg.finance.yahoo.com/quote/F03.SI/

[9]

https://foodempire.listedcompany.com/news.html/id/2438705

More Articles

The Power of Leverage in CFD

What is leverage? Read our article to find out more about the different uses of leverage through the use of Contract for Differences (CFDs) for both traders and long-term investors.

Why You Should Consider Dividend Investing

Have you tried dividend investing? Learn more about why you should consider dividend investing!

A Value(able) ETF During Rate Hikes

Interested in buying valuable ETFs? Read on our article to find out more!

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore (MAS).