USD – Undisputed King of all Currencies

Yeo Sze Han, Assistant Manager

Yeo Sze Han graduated from the National University of Singapore with a BSc (Hons) degree in Science. He has passed the Chartered Financial Analyst (CFA) level 1 examination and likes reading up on stock market news and updates.

Sze Han likes to incorporate fundamental and technical analysis when advising clients on stocks, ETFs and CFDs.

The Global Dominance of the US Dollar (USD)

The US Dollar (USD), often referred to as the “greenback” due to the distinctive green ink used on earlier US paper money, holds a paramount position in international trade and finance.

The USD is the most actively traded currency in today’s Forex(FX) market. This includes popular currency pairs such as the EURUSD, GBPUSD and USDJPY.

In addition to serving as the primary reserve currency for many central banks and governments worldwide, the USD plays a pivotal role in cross-border transactions. Its widespread acceptance and popularity also extends to its use as a reference for the value of various asset classes. Notably, the prices of energy products, precious metals, commodities, and even digital assets are often quoted in USD in the context of international trade and finance.

Though the USD’s dominance is beyond question, for further persuasion, let’s examine the history of the greenback.

The Rise of the USD Post-World War II(WWII)

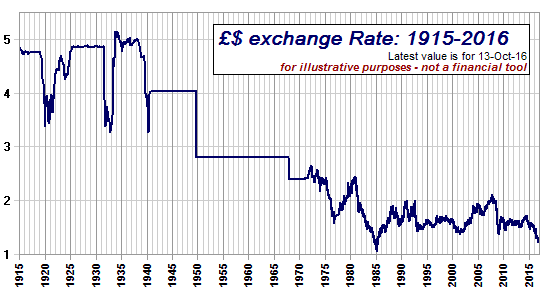

Before the 1940s, the British Pound reigned as the global dominant currency. However, the outbreak of WWII led to a substantial decline in the British Empire’s power and shifted the global economic landscape. The United States (US), initially hesitant to directly involve itself in the conflict, still provided essential military aid to Allied nations.

The turning point came with the unexpected Japanese attack on Pearl Harbor in 1941, prompting the US to declare war on Japan and its allies, Germany and Italy. Bolstered by the world’s largest Gold reserves and military might, the US was a formidable force, contributing significantly to the victory of the Allied forces made up of the US, Great Britain and the Soviet Union. The US’ leadership was further solidified with the D-Day invasion of Normandy Beach in 1944 and the deployment of atomic bombs in Hiroshima and Nagasaki in 1945.

After WWII, the US assumed a leading role in rebuilding war-torn Europe and Japan and played a crucial role in establishing international organisations like the United Nations, the North Atlantic Treaty Organization (NATO), and the Bretton Woods System.

Adoption of the Bretton Woods System

In the aftermath of WWII, a pressing need for economic stability and order emerged. In July 1944, representatives from 44 Allied nations convened in Bretton Woods, US. At the conference, an agreement was reached to peg the USD to Gold at a fixed rate of US$35 per ounce, with other major currencies subsequently pegged to the USD. The decision for this was due to the US’s growing economic and military might. This system became known as the “Bretton Woods system.”

Source: http://www.tradingview.com

The Free-Floating USD

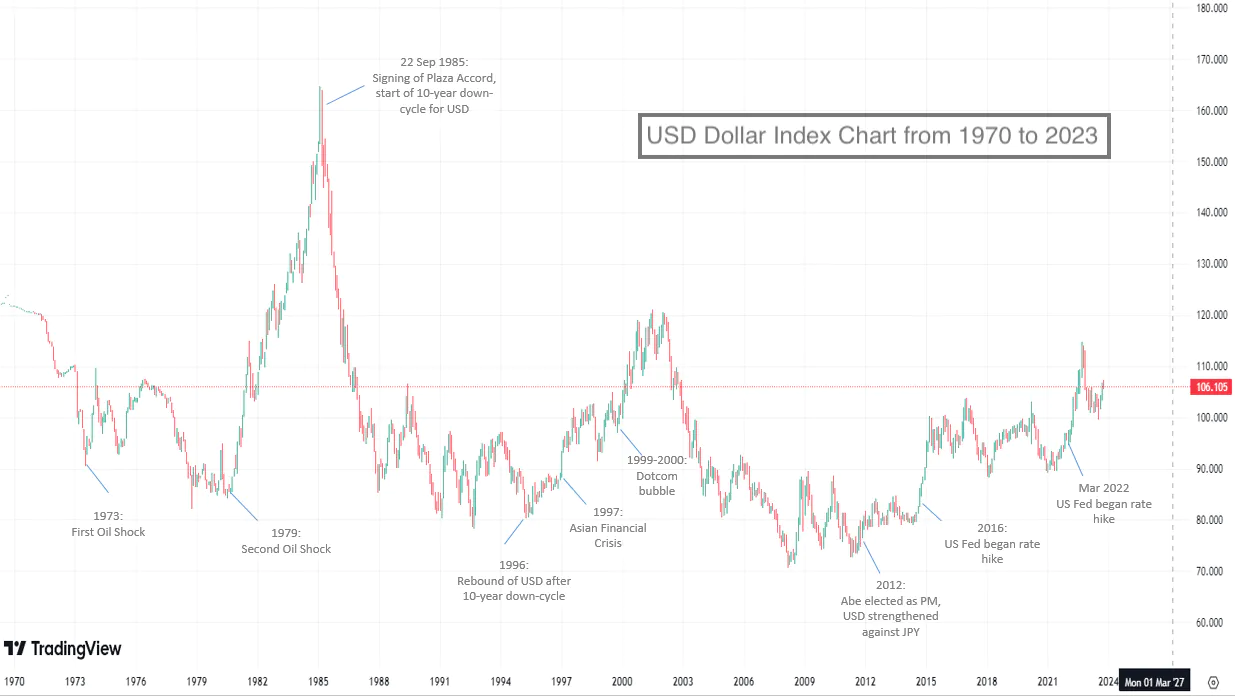

In the 1960s and 1970s, the US faced challenges, including rising inflation, trade deficits, and the financial burden of the Vietnam War. These issues compelled President Richard Nixon to announce the suspension of USD’s convertibility into Gold on 15 August 1971, marking the USD’s exit from the Bretton Woods system. This decision resulted in a devaluation of the USD and ushered in a new era of floating exchange rates.

The Plaza Accord of 1985

The early 1980s witnessed a significant appreciation of the USD, making American exports less competitive and causing global trade imbalances. To address this issue, the five major economies – the US, UK, West Germany, France, and Japan – signed the Plaza Accord in 1985. Their goal was to deliberately weaken the USD, particularly against the Japanese Yen and German Mark. The Plaza Accord succeeded in devaluing the USD, making American goods more competitive globally.

USD as a Safe Haven

The US global leadership has solidified the USD’s status as a “safe” currency, especially during financial and economic crises. This was evident by the influx of funds from investors as they sought safety throughout the first oil shock of 1973, second oil shock of 1979, the Asian financial crisis of 1997, the dot-com bubble of 1999, and the global financial crisis of 2008.

Unusual USD Strength Amid Unusual Times

The COVID-19 pandemic was a unique global crisis that prompted unprecedented fiscal and monetary measures from the US government and Federal Reserve to support individuals and corporations. The resulting inflationary pressures led to increased interest rates by the Federal Reserve, attracting money from other currencies and asset classes into USD and US Treasuries. Since March 2022, the strength and appeal of the USD have grown significantly. At the time of this writing, although US inflation is trending down, Fed officials have indicated a commitment to maintaining higher interest rates for longer. Against the current economic backdrop, it is likely that the current strength of the USD will persist for a while more.

In summary, the strength and dominance of the USD have been consistently demonstrated throughout time. The Bretton Woods system laid the foundation, cementing the USD as a pillar of global financial stability. Events such as the suspension of USD’s convertibility to Gold and the deliberate weakening through the Plaza Accord underscored the USD’s enduring strength. Furthermore, its role as a safe haven asset during past crises and present challenges, such as the Asian financial crisis and COVID-19 respectively, exemplifies the world’s unwavering confidence in the currency. Hence it’s justifiable for the USD to assert itself as the undisputed king of all currencies.

Promotions

From 2 October to 29 December 2023, enjoy up to S$120 cash credits every month and earn up to S$360 cash credits when you trade FX CFDs for 3 consecutive months (October, November and December). Start trading today!

*T&Cs Apply.

For more information, click here.

How to get started with POEMS

As the pioneer of Singapore’s online trading, POEMS’s award-winning suite of trading platforms offers investors and traders more than 40,000 financial products across global exchanges.

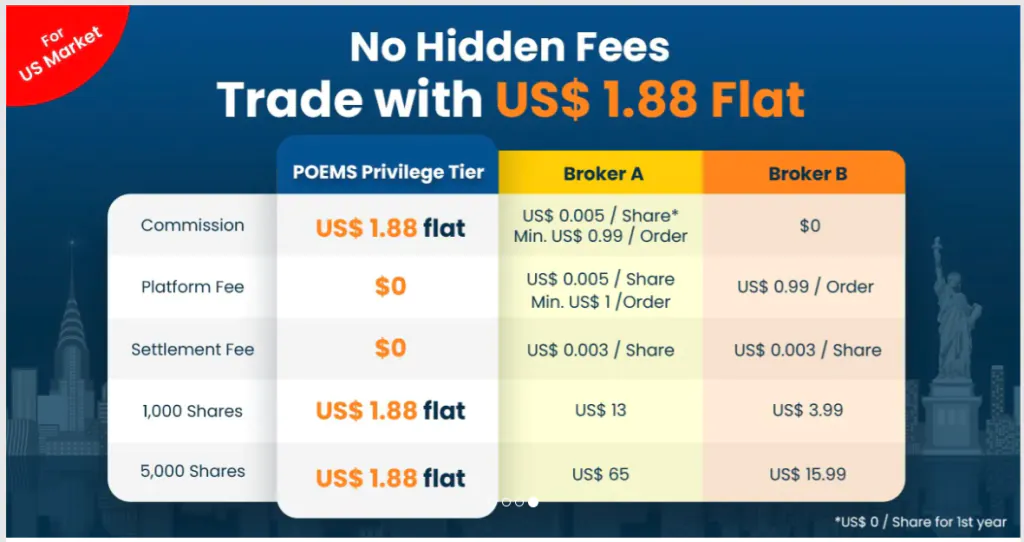

Explore an array of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today. Find out more here (terms and conditions apply).

We hope that you have found value reading this article. If you do not have a POEMS account and are interested in trading, you may visit here to open an account with us today.

Lastly, investing in a community can be a highly rewarding experience. Here, you will have the opportunity to interact with us and other seasoned investors who are enthusiastic in sharing their experience and expertise whether it’s through listening or answering questions.

In this community, you will also gain exposure to quality educational materials and stock analysis, to help you appreciate the mindset of seasoned investors and apply concepts you have learned.

We look forward to sharing more insights with you in our growing and enthusiastic Telegram community. Join us now!

For enquiries, please email us at cfd@phillip.com.sg.

More Articles

The Power of Leverage in CFD

What is leverage? Read our article to find out more about the different uses of leverage through the use of Contract for Differences (CFDs) for both traders and long-term investors.

Why You Should Consider Dividend Investing

Have you tried dividend investing? Learn more about why you should consider dividend investing!

A Value(able) ETF During Rate Hikes

Interested in buying valuable ETFs? Read on our article to find out more!

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore (MAS).