Using CFD to boost your ROI on Bond ETF

Jack Lee, Dealing

Jack Lee graduated from the University of Nottingham with a Bachelor’s degree in Business Economics and Finance. Companies with unique business models excite him. He is highly passionate about sharing his findings to help clients benefit from long-term high growth stocks. Thus, he is always on the hunt for stocks with value and potential for high growth.

Changes in the financial world are causing quite a stir lately. After the latest FOMC meeting and the publication of the dot plot by the US Federal Reserve (Fed), there were hints suggesting that interest rates could be on the verge of a significant shift. Additionally, it seems like we might be at the peak of the interest rate hike and the market is anticipating a decrease in interest rates in 2024. Being ahead of these changes could mean significant opportunities in the finance game. Let’s explore how these potential rate cuts might impact your financial strategies and how staying ahead of these moves can be your ticket to success.

What is a dot plot and how do we use it?

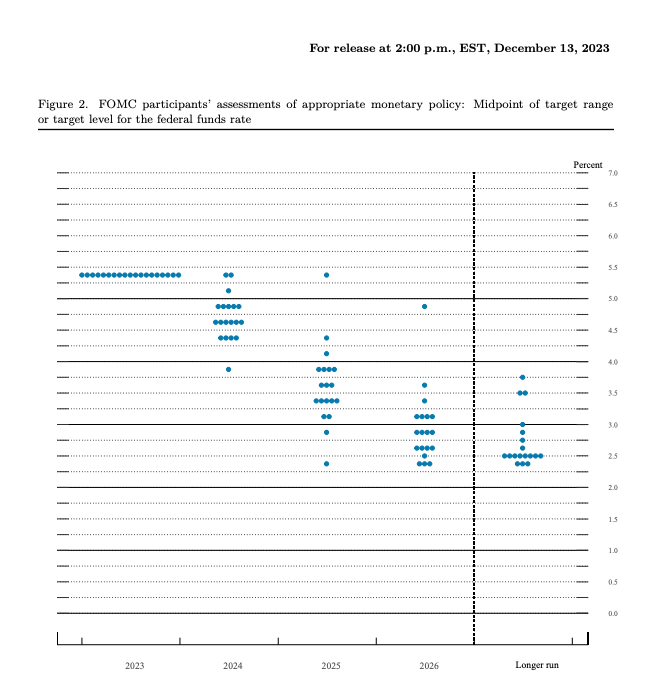

To begin, an investor should first learn how to interpret data and projections from the Fed in order to better strategise. One such way is to look at the Fed’s dot plot. The dot plot is a chart that illustrates the individual opinions of members of the Federal Open Market Committee (FOMC) regarding the future key interest rate and is updated every month

Here’s how to interpret the plot (figure below):

In the plot, each dot represents the opinion of each member of the FOMC. The vertical line (Y-axis) shows the interest rate, and the horizontal line (X-axis) shows the year they’re making predictions for. These dots help us understand what the Fed expects about future interest rates. If a majority of the dots are situated lower, it implies that many members of the FOMC are predicting rate cuts. Users of the plot will usually focus on the median dot too, as an indication of the Fed’s main prediction. Hence if you are looking to invest in bonds or stocks, checking the Fed’s projections might help to you figure out if it is a good time to enter.

Source: Federal Open Market Committee (FOMC) [1]

Analysing the current dot plot from FOMC on 13 Dec 2023, we anticipate a decrease in interest rates, given that the positions of the dots are shifting lower along the X-axis. FOMC left the target fed funds rate unchanged at 5.25% to 5.50% but looking ahead, by the end of 2024, the projection suggests a decrease in interest rate to 4.50-4.75%, indicating a potential 75 basis point (0.75%) drop from 2023 to 2024.

The trend continues into 2025, with the median projection dropping further to 3.50-3.75%, signalling an additional 100 basis points (1%) cut in 2025. Subsequently, by 2026, there’s an anticipated further 75 basis points reduction, potentially reaching a target rate range of 2.75-3.00%. This gradual decline projected by the FOMC suggests a series of rate cuts over the coming years.

Bond ETF investing - iShares 20+ Year Treasury Bond ETF (TLT)

Hence with a projected cut in interest rates, the current landscape suggests that interest rates are on the verge of reaching their peak. In such times, bonds, especially long-term Treasury bonds, emerge as an appealing avenue for potential capital growth. When interest rates decrease, long-term bonds have the potential for capital appreciation. This is because the older bonds with higher interest rates become more valuable in comparison to newly issued bonds with lower rates. Selling the bond before maturity could thus result in a capital gain. Therefore , buying bonds before the interest rates drop, increases our chances to benefit from potential price appreciation. Thus, investors can consider adding bonds to their portfolios.

With that in mind, let’s shift our attention to the iShares 20+ Year Treasury Bond ETF – TLT, a pivotal player in this scenario. Designed to mirror the US Treasury 20+ Year Bond Index and its performance, TLT offers investors exposure to a diversified collection of long-term US Treasury Bonds that are typically considered a safe investment product due to their backing by the US government. Their low-risk profile is further reinforced by the fact that US has not defaulted on its debt. Investors often turn to Treasury Bonds for stability and a guaranteed return on investment. It is a testament to the trust placed in the US government’s ability to meet its financial obligations.

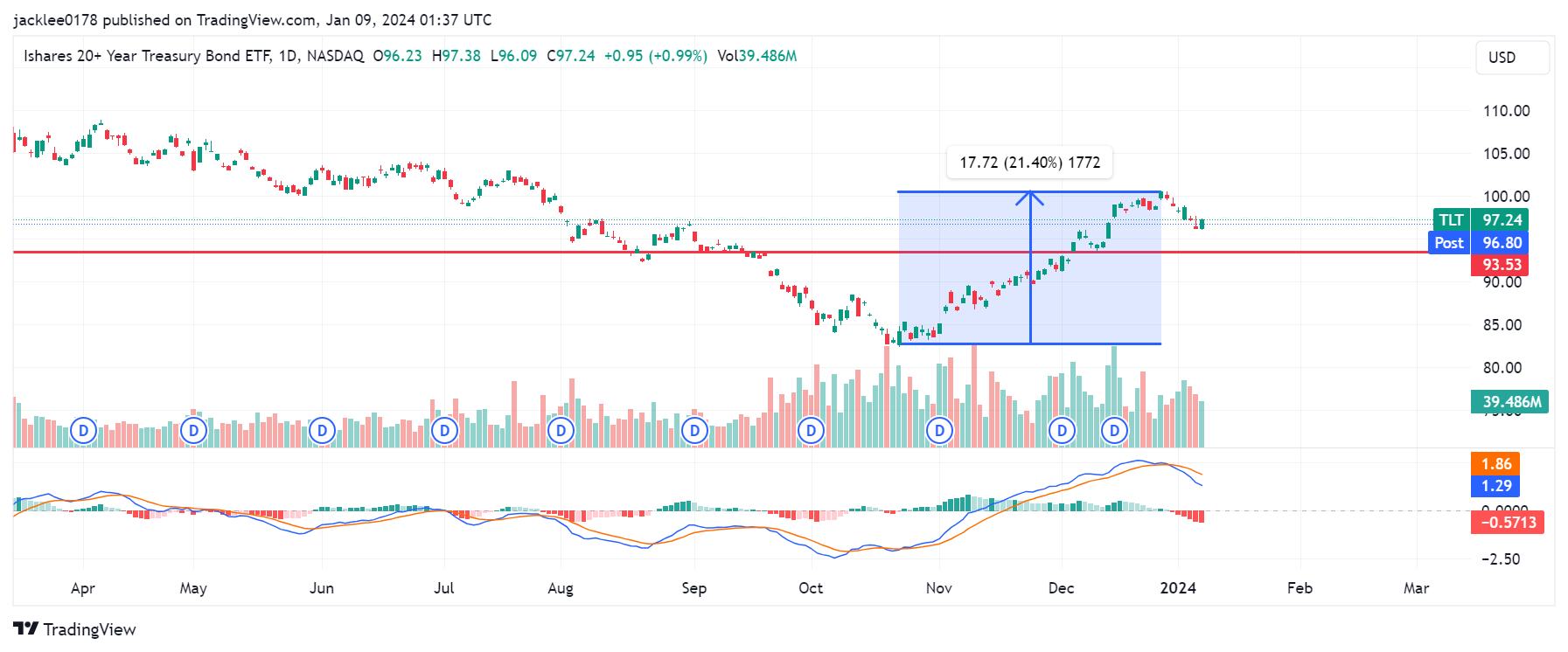

Source: Trading view [2]

Let us look at the price charts of TLT (as of 9 Jan 2024), we can see that TLT spiked almost 20% from the bottom. The price was affected by expectations of future interest rate cuts in 2024. With the spike in prices, based on our technical analysis, the price of 92-94 would now act as an important key level. For investors who would like to add TLT into your portfolio, you may keep a lookout at these price levels

Use CFD to boost your ROI

Noting how TLT is sensitive to interest rate changes, it is thus an investment product we can consider in the current macro environment. The question remains, can we boost our ROI should we invest in TLT? The answer is affirmative, utilising Contracts for Difference (CFD) provides an avenue for additional potential gains!

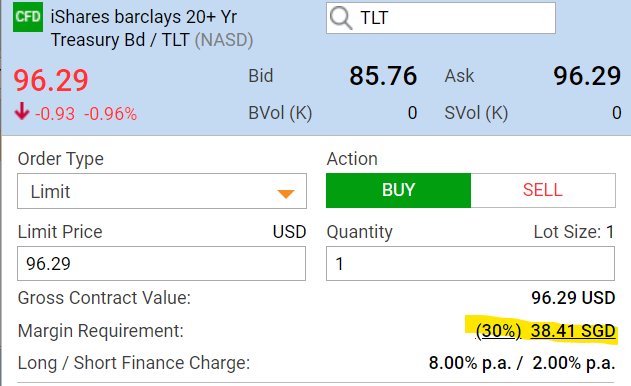

The most powerful weapon for CFD would be the leverage it provides. Leverage in the context of CFDs refers to the ability to control a larger position in an asset using a smaller amount of capital outlay. This approach is usually suitable for people with a high-risk appetite and would like to do a short-term trade on Using Phillip CFD as an example to demonstrate “leverage”, in order to buy TLT, investors would only need to put down 30% of the total value of the TLT shares (highlighted in the image below).

At the time of writing, the price of TLT shares is US$96.29. With leverage, investors can acquire TLT with only 30% of their funds, equivalent to US$38.41.

Leverage in CFDs also offers another advantage, the magnifying of potential returns on your investment! When the price of TLT increases, your profits are calculated based on the total value of the shares, not just the initial investment amount. In this scenario, your ROI has the potential to significantly increase with the same lower initial capital outlay. This would also free up capital, allowing investors to trade in more markets and assets, giving investors more flexibility to react to market changes.

Risks

Just like how there are two sides to a coin, leverage also comes with its associated risk. While leverage helps to amplify your gains, the flip side is also true. Losses are amplified with leverage too. If the market moves against your position, losses can accumulate rapidly, and it is possible to lose more than the initial investment. This worst case scenario happens when accumulated losses trigger a margin call. When this happens, customers are mandated to deposit additional funds in order to cover the incurred losses and uphold their current position. Failure to meet margin call requirements can force the closure of your position at the current market price, potentially leading to significant losses, possibly exceeding the initial investment.

Therefore, when using CFDs, it is crucial to have a comprehensive risk management strategy in place to mitigate these amplified risks.

Apart from this, investors should also be aware of the finance charges in CFD trading. This refers to the interest costs incurred when keeping positions open overnight. The charges are influenced by interest rate differences, position size, and market conditions and can reduce profits and impact risk management. Investors should be aware of these costs when planning trades, and consider opting for shorter-term strategies as well as stay informed about economic events affecting interest rates to minimise charges. Understanding and managing finance charges is thus crucial and can help enhance overall profitability.

Conclusion

The iShares 20+ Year Treasury Bond ETF (TLT) emerges as an intriguing investment avenue in this landscape, with the potential to capital appreciation. Utilising CFDs allows us to further amplify our ROI with increased market exposure and lower initial capital outlay. However, the amplified gains do come with heightened risks. Investors should thus approach leveraged trading cautiously, with a clear understanding of the associated risks and have a robust risk management strategy to navigate the markets effectively.

Promotions

Get a S$30 Cash credits Welcome Bonus when you open a POEMS CFD MT5 account and fund S$2000 into the account!

*T&Cs Apply.

For more information, click here.

How to get started with POEMS

As the pioneer of Singapore’s online trading, POEMS’s award-winning suite of trading platforms offers investors and traders more than 40,000 financial products across global exchanges.

Explore an array of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today. Find out more here (terms and conditions apply).

We hope that you have found value reading this article. If you do not have a POEMS account and are interested in trading, you may visit here to open an account with us today.

Lastly, investing in a community can be a highly rewarding experience. Here, you will have the opportunity to interact with us and other seasoned investors who are enthusiastic in sharing their experience and expertise whether it’s through listening or answering questions.

In this community, you will also gain exposure to quality educational materials and stock analysis, to help you appreciate the mindset of seasoned investors and apply concepts you have learned.

We look forward to sharing more insights with you in our growing and enthusiastic Telegram community. Join us now!

For enquiries, please email us at cfd@phillip.com.sg.

More Articles

The Power of Leverage in CFD

What is leverage? Read our article to find out more about the different uses of leverage through the use of Contract for Differences (CFDs) for both traders and long-term investors.

Why You Should Consider Dividend Investing

Have you tried dividend investing? Learn more about why you should consider dividend investing!

A Value(able) ETF During Rate Hikes

Interested in buying valuable ETFs? Read on our article to find out more!

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore (MAS).