Why does Hedging FX Risk Matter to You?

Kenneth Tan, Head of FX CFD

Kenneth Tan graduated from Nanyang Business School with a Master of Science in Financial Engineering. Having worked as a spot and NDF trader for a top bank in Japan and an option dealer with one of France’s top five banking groups, Kenneth has devoted more than 15 years to developing the FX business and strongly believes that investing in FX instruments is essential to every investor. He enjoys learning about how automated strategies can enhance trading experience for clients.

Sam Hei Tung, Dealing

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Everyone experiences foreign exchange (FX) risk one way or another, knowingly or unknowingly. Some examples include:

- Traders who buy shares of US companies

- Investors who put their money in unit trusts, or funds, based in other currencies

- A company selling its beverage to other countries

- A retail shop selling clothes bought, or imported from suppliers in Thailand and Hong Kong

- A student going for an overseas exchange programme in Australia

- Holiday seekers travelling to Japan

Simply put, if you would like to keep your assets in Singapore dollars, activities related to overseas instruments such as stocks and bonds, could put you at risk of suffering losses when FX rates go wayward. FX rates can have a significant impact on portfolio returns. The easiest way to show this is with the following example:

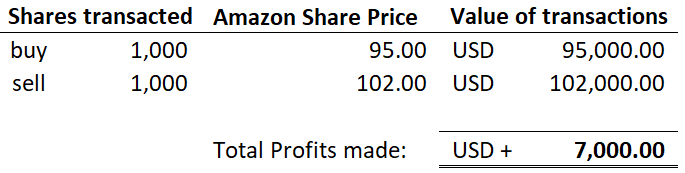

A Tale of Two “Currencies”

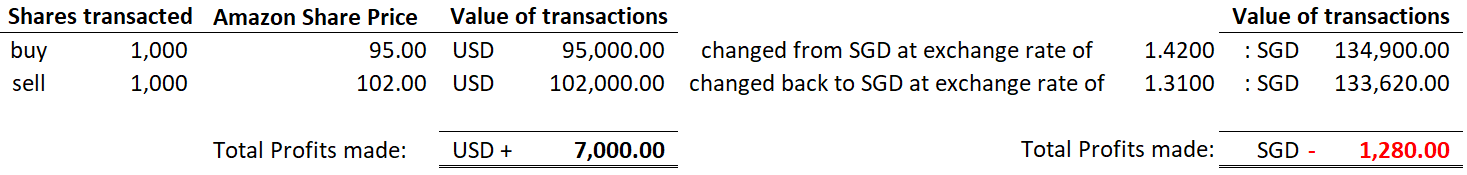

In his research on Amazon.com, Mr Tan found that it was undervalued on 2 November 2022. To capture opportunities of the price appreciating, he converted his Singapore Dollars to US Dollars and purchased 1,000 shares of Amazon.com at US$95.00. After holding on to this investment for a few months, he was delighted that the price of Amazon.com rose to US$102.00 at the start of February 2023. He quickly sold 1,000 shares to capture profits. Upon calculation, he was happy that he made US$7,000 (see calculation below).

Mr. Tan wanted to change his USD back to SGD so that he could make investments in Singapore shares. Upon conversion, he found it strange that a higher account balance was not achieved and investigated why. To his horror, he realised that the USD to SGD exchange rate had gone against him. Instead of making US$7,000 in profit, he incurred a loss in terms of SGD.

So, what is FX Hedging?

FX hedging refers to a strategy of minimising risks that come with transactions denominated in foreign currencies. Since FX rates can have a significant impact on portfolio returns, investors should consider hedging this risk where appropriate. Traditionally, FX hedging involves trading currency futures, forwards or options, or purchasing the currency itself. The relative complexity of these strategies has hindered widespread adoption of FX hedging by the average investor.

FX Contract For Difference (CFD) provides an easy, cost-effective way for retail investors who wish to mitigate exchange rate risk. FX CFD rates refer to the price at which a currency e.g. USD can be exchanged for another e.g. SGD. The exchange rate will rise or fall as the value of each currency fluctuates against the other. FX CFD only requires a small deposit known as margins, of the full contract value to establish the hedge position, allowing you to maximise your capital with other forms of investments. You can enter and exit FX CFD positions anytime, and enjoy a high level of flexibility to handle long-term exposures or specific event risks.

It is a fairly simple concept. If you place funds in US assets e.g. stocks, you should short (or sell) USD relative to SGD to hedge. If USD loses value (also known as depreciating) causing value loss in your US assets relative to SGD, the hedge would profit. Conversely, if USD is gaining in value (also known as appreciating), the hedge will suffer losses. The hedge, by definition, counterbalances the unpredictable exchange rate swings of the US assets relative to SGD value, allowing investors to concentrate on price fluctuations of the US asset itself.

FX CFD is the answer to your hedging needs

Simply open a CFD account to hedge your exposures to various currencies. Taking the above example, if Mr. Tan had sold 10 mini lots of USD/SGD CFD (10,000 notional per mini lot contract) at 1.4200 as an FX CFD hedge, he would have covered his 95,000 exposure in US dollars. When the USD started to move unfavorably against him, his hedge would gain on the depreciation in USD. Eventually, when he does sell his US shares, he could also exit his hedge at 1.3100.

- Profits on FX CFD hedge = (1.4200 – 1.3100) x 10 mini lots x 10,000 per mini lot = S$ 11,000

- Capital requirements on FX CFD hedge = 5% margins on 100,000 = US$5,000

- Cost of hedge = 0 (FX CFD is zero commissions and has zero financing charges)

- Swap Rollover (estimated accumulation holding USDSGD.FX.CFD for 3 months) = -0.0050

Don’t Exchange Rates Also Change Favourably?

It is true that exchange rates may change favorably as it does unfavorably. Although this might be the case, majority of investors and businesses aim to focus on where their expertise lie and not depend on currency changes.

Reducing/ Removing FX risk as a variable

FX CFDs can actually protect your portfolio from unexpected FX risks and aid you in reaching your investment goals. Alternatively, investors can use FX CFDs to hedge on short-term event risks such as economic data releases or corporate news announcements.

“I can just wait until the FX rate swings back”

Foreign exchange markets are volatile. As such, FX rates to swing back potentially. However, if we see the following charts, it can be seen that for certain currency pairs some of these levels are never seen again.

The chart above shows the USD/SGD for the past 15 years. The currency pair may take months or even years to return to that level. As investors/traders, we might not be able to wait for such long and unknown periods before being able to safeguard the FX conversion value.

At the extreme end, the SGD/JPY has been appreciating since 2013, highlighting the importance of hedging FX risk to reduce/eliminate FX risk exposure. As FX rates can deviate largely across time and “waiting until FX rate to swing back” will be costly to traders and investors.

In conclusion, everyone experiences FX risk directly or indirectly. FX risk can be extremely costly during times of volatility. By using FX CFDs to hedge FX risk, traders can minimise or even eliminate FX risk, therefore becoming immune to the movements of the FX markets, which can be very unpredictable. With a small contract size of $10,000 of the base currency, traders can hedge with ease and avoid the risk of over hedging.

How to get started with POEMS

As the pioneer of Singapore’s online trading, POEMS’s award-winning suite of trading platforms offers investors and traders more than 40,000 financial products across global exchanges.

Explore an array of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today. Find out more here (terms and conditions apply).

We hope that you have found value reading this article. If you do not have a POEMS account, you may visit here to open one with us today.

Lastly, investing in a community is much more fun. You will get to interact with us and other seasoned investors who are generous in sharing their experience and expertise.

In this community, you will be exposed to quality educational materials, stock analysis to help you apply the concepts, unwrap the mindset of seasoned investors, and even post questions.

We look forward to sharing more insights with you in our growing and enthusiastic Telegram community. Join us now!

For enquiries, please email us at cfd@phillip.com.sg.

Promotions

Earn up to S$360 cash credits when you trade FX CFDs!

From 3 July to 29 September 2023, enjoy up to S$120 cash credits every month and earn up to S$360 cash credits when you trade FX CFDs on POEMS for 3 consecutive months (July, August and September).

*T&Cs Apply.

For more information, click here.

References

[1] https://www.investopedia.com/articles/trading/04/042104.asp

[2] https://www.babypips.com/learn/forex/summary-developing-a-trading-plan

[3] https://www.babypips.com/learn/forex/mechanical-trading-systems

[4] https://www.dailyfx.com/education/find-your-trading-style/trading-plan.html

[5] https://bookmap.com/blog/how-to-create-a-trading-plan/

[6] https://www.phillipcfd.com/what-is-fx-cfd-why-you-should-trade-them/

More Articles

The Power of Leverage in CFD

What is leverage? Read our article to find out more about the different uses of leverage through the use of Contract for Differences (CFDs) for both traders and long-term investors.

Why You Should Consider Dividend Investing

Have you tried dividend investing? Learn more about why you should consider dividend investing!

A Value(able) ETF During Rate Hikes

Interested in buying valuable ETFs? Read on our article to find out more!

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore (MAS).