Investing in the Next World Beater

Khoo Gek Han, Dealer

Gek Han is a securities dealer in the largest dealing team in Phillip Securities, specialising in Equities, ETFs and CFDs. As a securities dealer, he provides equity-related advisory for clients.

He looks at securities from a technical and fundamental perspective, and wants to explore managing investments using a portfolio approach. Gek Han holds a Bachelor of Science (Economics) degree with double majors in Economics and Finance from Singapore Management University.

What this report is about:

- The Rule of 40 is a metric investors use to sieve out quality software companies

- Shortlisted stocks that may have the potential for long-term capital appreciation, based on the Rule of 40

- How to incorporate the Rule of 40 with other traditional metrics like the price-to-sales ratio

Investors are constantly on the lookout for a “foolproof” way of making money in the markets. Unfortunately, certainty is the last thing investors will find in the markets. Those who embrace the uncertainty will reap better investment results.

Nevertheless, investors should pursue a sound investment methodology when navigating the markets. One such method that Phillip Securities has extensively researched on is the Rule of 40.

The Rule of 40

The basic premise behind the Rule of 40 is that one year’s revenue growth rate plus earnings before interest, tax, depreciation and amortisation (EBITDA) margin should exceed 40% as a high level gauge of performance for software companies.

The Rule of 40 emphasises the importance of finding companies that are able to manage the balance between growth and profitability to create long-term value. The growth and profitability of a company are usually at odds with each other. To drive growth, the company would need to incur expenses. Finding the right mix or balance between the two can be tricky. The Rule of 40 tries to balance and provide a trade-off between them. Investors are usually willing to tolerate low profits or even losses as long as a company is demonstrating strong growth. [2]

The Rule of 40 has been widely-adopted by practitioners, venture capitalists and investors to evaluate software companies. For more information, please refer to this article and/ or the infographic below.

Let us now look at some stocks that may have the potential for long-term capital appreciation based on the Rule of 40.

The Trade Desk (TTD)

The Trade Desk is a digital advertising company that provides a platform for its customers to purchase advertising space. The company does not buy or own any media or advertising assets. Instead, it offers an online advertising platform for customers to access advertising campaigns in a variety of channels, ranging from display, social, mobile, video, and more. Its clients would then purchase this access, with the promise of being more effective at reaching a targeted audience, offering more granular feedback about the effectiveness of an advertisement. The Artificial Intelligence (AI) that the platform taps on enables customers to optimise their spending based on budget, geography, and target audience.

Unlike many companies in the software space, The Trade Desk is profitable and has no long-term debt. For the past five years, its customer retention rate has been consistently above 95%. [1] Although the stock trades at rich valuations, the rise of connected TV is a growth driver that could justify those valuations. A greater portion of advertising spend will make the shift from traditional television to connected TV in the coming years. According to financial services firm Stephens, US advertising spend in the connected TV space will grow from a rough estimate of USD 9 billion to USD 72 billion in the coming years. [3]

As the economy rebounds, coupled with the shift in trends of the advertising market, the interest from ad buyers is expected to shift as well. This shift is poised to benefit The Trade Desk as a leader in the digital advertising space.

Atlassian (TEAM)

Atlassian is an Australian cloud-based software company that designs and develops enterprise software. The company offers project management, collaboration, issue tracking, integration, deployment, and support services. Some of its tools include Jira for business management and project tracking, Trello and Confluence for collaboration and tracking of projects and documents, Bitbucket and Bamboo for coding and managing software releases, and Atlassian Access for cloud security.

Since Atlassian went public in 2015, its total revenue has nearly quadrupled from USD 457 million in financial year 2016 to USD 1.6 billion in financial year 2020. The company transitioned to a subscription-based business model and saw its recurring sales increase by sevenfold. Other sources of revenue grew at a comparatively slower speed, but the shift in business model gave Atlassian a stable foundation of sales to build on. The COVID-19 pandemic sped up Atlassian’s pace of growth last year as companies across the globe were forced to work remotely, accelerating the demand for Atlassian’s workplace collaboration products. In the last quarter of financial year 2021, the company added over 23,000 net new customers, doubling year-over-year. The company finished the year by topping 200,000 customers and USD 2 billion in revenue [4].

Upstart Holdings (UPST)

Upstart provides a cloud-based lending platform that uses a unique proprietary model driven by Artificial Intelligence to make a more accurate evaluation of one’s creditworthiness than traditional credit scoring. For consumers, this improves access to credit at lower interest rates. For Upstart’s partner banks, this improves profitability and loan underwriting quality, reducing the risk and costs of lending.

Upstart’s revenue has more than quadrupled in the past three years, with full-year 2020 numbers rising 42% from the previous year. Upstart’s platform handled more than 300 million loans last year, with annual growth in volume averaging at 62% since 2017 [5]. Despite only being public-listed in December 2020, Upstart is already profitable. Its adjusted net income surged more than five folds year-over-year. More importantly, Upstart’s growth has come without deterioration in credit standards. Fraud rates have remained steady even as more of the platform’s loans become fully automated, proving the validity of Upstart’s business model.

Upstart’s CEO and co-founder Dave Girouard has considerable experience in the technology industry. Previously as President of Alphabet’s Google Enterprise division, he was instrumental in the development of Google’s cloud applications business. In addition, Girouard also has substantial interest in the financial success of Upstart, with a massive 17% stake in the company.

Currently, Upstart is in the business of originating personal loans. It is also preparing to enter the auto loan market. Earlier this year, the company announced that it would acquire auto retail software specialist, Prodigy Software. It also targets to broaden its scope of services in the future to cover mortgages, student loans, and credit cards. This would open up a bigger addressable market and more business opportunities in time to come.

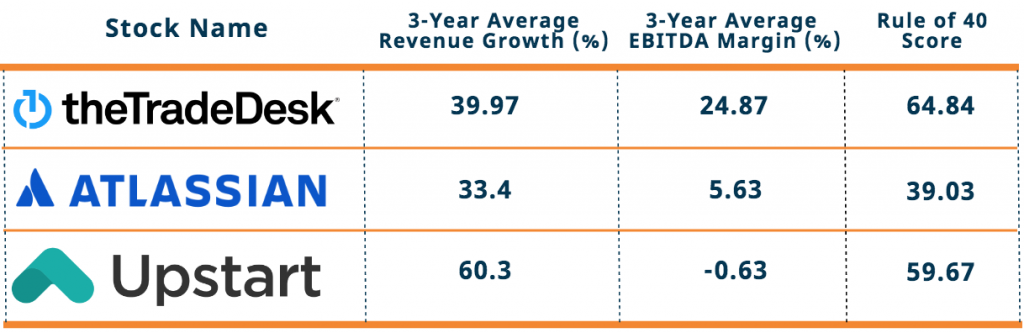

Quantitative Evaluation

Next, let’s see how the above companies stack up, using the metrics in the Rule of 40. To smoothen year-to-year fluctuations, we use the 3-year average year-on-year revenue growth and 3-year average EBITDA margin.

As investing legend Benjamin Graham once said, “the market is like a voting machine in the short-run and a weighing machine in the long-run”. At certain points in time, we may notice stocks where their relative valuations do not commensurate with their Rule of 40 scores.

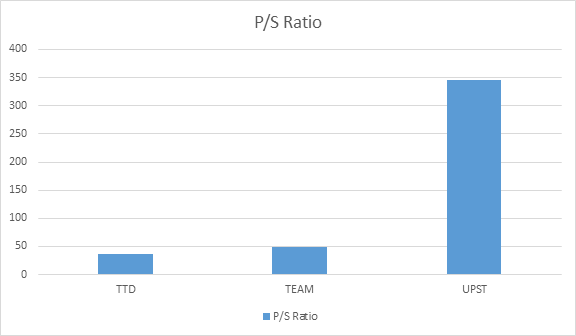

For example, a common metric used to judge whether a growth stock is expensive or cheap is the price-to-sales (P/S) ratio. A stock with a higher P/S ratio is more expensive than one with a lower P/S ratio.

From the comparison, The Trade Desk has the highest Rule of 40 score, but the lowest P/S ratio; much lower than Upstart’s whopping P/S ratio of 344.89. This could mean that at current price levels, The Trade Desk is a better bargain than the other two companies.

Investors can use the Rule of 40 as a stock selection criterion for high-growth companies. These companies tend to spend heavily on sales, marketing and research and development to spur revenue growth. The Rule of 40 helps you to sift out companies that are not yet profitable but offer strong revenue growth prospects. Today, many investors use it to assess any fast-growing digital-economy company. [6]

Investors and traders with a bigger risk appetite may consider using Contracts for Differences (CFDs) to gain exposure to these stocks.

Trading with Contracts for Differences (CFD)

Contracts for Differences (CFDs) are versatile investment tools. They are particularly ideal for people who wish to take a more active approach to investing. CFDs can be used for hedging, short-selling or leveraged trading. They only require a minimum sum upfront, which is known as the margin requirement.

CFDs are also ideal tools for investors without much capital outlay but wish to capitalise on the growth potential of thematic investing.

Example 1 illustrates how CFDs can amplify returns with an initial margin paid upfront.

Example 1:

| Equity trading | CFD trading |

| On 13 October 2021, Edwin initiated two open positions on Stock X | |

| Stock X share price = S$1.00

Share quantity = 10,000

Total value of shares = S$1.00 x 10,000 = S$10,000 |

Stock X share price = S$1.00

CFD contract quantity = 10,000 Total CFD contract value = S$1.00 x 10,000 = S$10,000

Assuming that the margin requirement for Stock X is 10%, the required margin would be = S$1,000 (S$10,000 * 10%) |

| Total capital commitment = S$10,000 | Total capital commitment = S$1,000 |

We illustrate with two scenarios for Edwin on 14 October 2021

Scenario A: Stock X increased by 10%

| Equity trading | CFD trading |

| Stock X share price = S$1.10

*Gross profit/loss = (S$1.10 – S$1) * 10,000 = S$1,000

|

Stock X share price = S$1.10

^Gross profit/loss = (S$1.10 – S$1)*10,000 = S$1,000

|

| *Return on investment = S$1,000/S$10,000

= 10% |

^Return on investment = S$1,000/S$1,000

= 100% |

Scenario B: Stock X decreased by 10%, Edwin decided to cut losses on both his positions.

| Equity trading | CFD trading |

| Stock X share price = S$0.90

*Gross profit/loss = (S$0.90 – S$1) * 10,000 = -S$1,000

|

Stock X share price = S$0.90

^Gross profit/loss = (S$0.90 – S$1) * 10,000 = -S$1,000

|

| *Return on investment = S$1,000/S$10,000

= -10% |

^Return on investment = S$1,000/S$1,000

= -100% |

* Calculations omit commissions, clearing fees and other trading fees in share trading. Actual ROIs will be lower than the ROIs calculated.

^ Calculations omit commissions and finance charges for CFD trading. Actual ROIs will be lower than the ROIs calculated.

CFDs, however, may not be suitable for investors whose investment objective is to preserve capital and/or whose risk tolerance is low.

To understand more about CFDs, read our article on “Understanding Contracts for Differences”.

We sincerely hope that you have found value in reading this article!

If you do not have a POEMS account, you may visit this link or scan the QR code below to open one with us today!

Open a POEMS account within minutes and trade instantly!

For enquiries, please email us at cfd@phillip.com.sg. If you are interested in active discussions, you can also join our Telegram community here.

References

[1] The Trade Desk Form 10-K filing https://investors.thetradedesk.com/static-files/c2a95bea-47e8-4049-8850-676907a62d81

[2] https://www.fool.com/investing/2019/09/25/introducing-the-rule-of-40-and-why-investors-shoul.aspx

[3]

https://www.nasdaq.com/articles/heres-why-the-trade-desks-stock-shot-higher-friday-2021-07-23

[4] Atlassian Form 10-K filing https://s28.q4cdn.com/541786762/files/doc_financials/2021/ar/FY21-Annual-Report-on-Form-20-F.pdf

[5] Upstart Holdings Form 10-K filing https://sec.report/Document/0001647639-21-000004/

[6] https://www.sharesmagazine.co.uk/article/discover-a-great-tool-for-valuing-high-growth-companies

More Articles

The Ultimate Guide to Trading and Investing in Stocks Listed in HKEX

Fun fact: Did you know? The Hong Kong Stock Exchange finished 2020 as the second-biggest IPO market globally! Read our latest article to find out more!

Can Value Still Be Found in Alibaba Group Holding?

Can Value still be found in Alibaba Group Holding? Read our article to find out more!

Hang Seng Index's Biggest Revamp in 51-Year- History: Winners & Losers

Who are the potential winners and losers for the revamp of the Hang Seng Index? Read on our article to find out more!

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore (MAS).