The Ultimate Guide to Trading and Investing in Stocks Listed on HKEX

Published On: 6 January 2021 | 18:00 PM

Brigitte Fang Shu’En, Dealer

Brigitte is a dealer for Contract for Differences (CFD) who is an avid lover of trading Asian markets and aspire to trade the European markets one day. She has experience trading intraday in both the Hong Kong and Singapore markets. Prior to joining PhillipCapital, she studied Quantitative Finance in National University of Singapore.

In her free time, Brigitte enjoys reading books on trading and following the latest market news on HK IPOs.

Have you ever felt pangs of disappointment when you find a perfect trade on the Hong Kong Stock Exchange, only to realise you cannot afford the capital outlay?

I have! I often had to deal with this sinking feeling when I first started trading back in my university days.

Fun fact: Did you know? The Hong Kong Stock Exchange finished 2020 as the second-biggest IPO market globally! [1]

Well, good news for you!

Our newly launched Micro Trading for the Hong Kong Stock Exchange will help you circumvent the issue of capital outlay and lot sizes!

What is Micro HK CFD Trading?

Micro HK CFD Trading is the same as trading your favorite Hong Kong counters. The only difference is, you are not subject to the minimum board lot size requirement.

With Micro HK CFD Trading, you can purchase a single unit – one share in stock-trading terms – and take advantage of more frequent market gyrations!

Read on to learn more about the advantages of Micro HK CFD Trading!

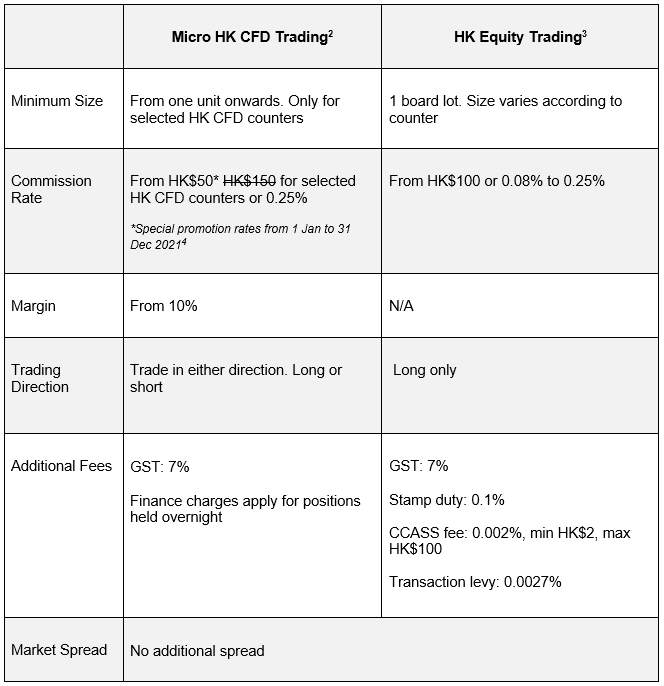

Micro HK CFD Trading vs HK Equity Trading

Table 1: Comparison between Micro HK CFD Trading vs HK Equity Trading

Benefits of Micro HK CFD Trading

1. Roll and compound that snowball earlier!

With Micro HK CFD Trading, you can invest in the counters of your choice without fretting about minimum lot sizes! No counter would be too expensive and out of your reach.

Picture this. You wish to own Tencent Holdings, the owner of WeChat and the platform that connects the most of China. Assuming Tencent is trading at HK$500 a share with a minimum board lot size of 100, you would need a minimum of S$8,500 to enter into this position.

But with Micro HK CFD Trading, you can buy even a single contract! What’s even better is that CFDs allow you to trade on margin. You would only need to fork out a 10% initial margin for that single share!

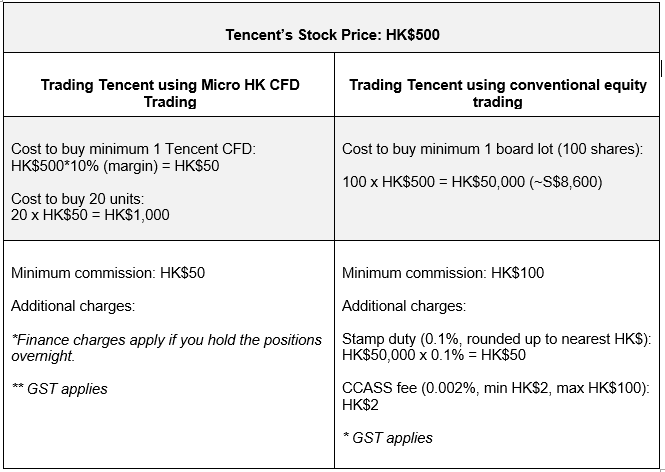

Example 1 illustrates how Micro HK CFD Trading may assist you.

Example 1

Table 2: Comparison between equity trading and CFDs (for illustration purposes only)

In Example 1, your initial HK$1,000 outlay will not be sufficient to purchase one board lot of 100 Tencent shares. But by using CFDs, you will be able to purchase 20 contracts of Tencent CFDs.

2. Diversification with the help of contract value sizing

With Micro HK CFD Trading, you can diversify your portfolio! This is due to your ability to determine and manage the size of your positions on individual counters even with limited capital.

Figure 1 below illustrates how a trader can gain exposure to certain counters using both equity trading and CFD trading.

Mike, the trader, has HK$15,000 or about S$2,500 of capital to trade.

After doing his homework, Mike decides to take positions on Alibaba (HKG:9988), Meituan (HKG:3690) and JD.com (HKG:9618). However, to trade JD.com using conventional equity trading, he would need to buy a minimum board lot of 50 shares. Assuming JD.com (HKG:9618) trades at HK$300 per share, his capital of HK$15,000 is just enough for a minimum board lot of 50 shares.

However, with the assistance of Micro HK CFD Trading, Mike can take positions on all three of his selected counters and achieve greater diversification with his capital outlay!

Figure 1: Comparison between shares and CFDs (for illustration purposes only)

3. Corporate action entitlements

Clients who hold long positions on equity CFDs are entitled to dividends, stock splits, stock consolidation, rights issues etc. With Micro HK CFD Trading, those who hold long positions are entitled to the quantities rounded down as fractional shares are not catered for.

For short positions, certain corporate actions may require clients to liquidate their holdings one day before the ex-dividend dates. Additionally, clients will be required to liquidate their positions for those corporate actions that PhillipCapital does not cater for.

For more information, please check out our CFD information sheet.

4. Hedge your portfolio against rising uncertainties with CFDs

Contrary to popular opinion, Contracts for Differences (CFDs) are not just for technical traders. Long-term investors can utilise CFDs to hedge their positions against unforeseen events and uncertainties. When investors foresee rising uncertainty and volatility in the market, they can enter into CFD contracts to hedge their positions.

CFD World Indices and Commodities are ideal hedging tools for equities. This is due to their cost effectiveness and correlations.

One can use CFDs as a hedge in the following two possible scenarios:

1) When the price of your existing position has already moved / is moving against you.

2) When you anticipate future gains in your existing positions to be marginal due to increasingly negative market sentiment.

For an illustration of how to use CFDs for hedging, check out the bottom of this article.

5. Odd lot sizes at board lot prices

There may be occasions when corporate actions leave clients with additional odd lot shares. These odd lot shares are traded at a lower price than in the board lot market due to their lower liquidity. This is disadvantageous for clients when they do decide to liquidate their odd lot shares. Additionally, clients cannot liquidate their odd lot shares directly on POEMS but are required to call in to place their orders via the dealing desk. These trades are subject to broker-assisted commission rates.

With Micro HK CFD Trading, you can trade selected HK counters in odd lot sizes at the original board lot prices on POEMS. Micro HK CFD Trading thus provides much more flexibility and convenience than buying shares directly.

Micro HK CFD Trading available for selected HK Equity CFDs, with reduced minimum commissions!

From 4 January 2021 to 31 December 2021, trade selected Hong Kong Equity CFD counters from one contract onwards, with reduced minimum commissions of HK$50.

No sign-up necessary. All you have to do is to make the qualifying HK Equity CFD trades during the promotion period and the lowered commission rates will apply to you. It’s that simple!

For a full list of HK Equity CFD counters available for this promotion, please refer here.

Find out more about Micro HK CFD Trading now!

References

[1] https://www.scmp.com/business/companies/article/3090404/hong-kong-and-shanghai-locked-tight-race-be-2020s-top-ipo-venue

[2] Full list of Micro HK CFD Trading counters available here.

[3] For full details of Hong Kong stocks offered by POEMS, please refer here.

[4] T&Cs apply. Promotion details for Micro HK CFD Trading can be found here.

More Articles

The Opportunities in China's New Economy

What are the opportunities that investors could look for in the China’s new economy? Read our latest article to find out more about the China market!

Take advantage of Volatility! Embrace it, Don't Fear it!

2020 has been an eventful year which has led to spikes in market volatility. Ride on the wave of volatility and learn how you can take advantage of the volatility by trading CFDs

US Small Caps as an Economic Barometer?

Did you know that US small-cap stocks are often perceived as a reliable economic barometer of US economic activity? Read this article to learn more!

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore (MAS).