Is CFD for you?

Lim Si Hong, CFD Dealer

Published On: 3 April 2019 | 05:00 PM

After learning about CFD from the previous article, it’s time to now think through the following questions to see if such a product suits your investment needs.

What is your risk appetite?

ALL investments come with risks, no doubt about that. Even deposits in our three local banks (OCBC, DBS, UOB) that earn you a mere 0.05% interest per annum will also come with the risk of the banks going insolvent, threatening to potentially forfeit your deposits. (Though your core savings with banks and finance companies licensed in Singapore are protected under the Deposit Insurance Scheme.)

Maybe depositing your cold hard cash into a biscuit tin would be the safest way to park your money, like how our ancestors did. Then again, the risk of inflation might be the bug that will erode your money bit by bit, leaving you with lesser and lesser purchasing power over the years.

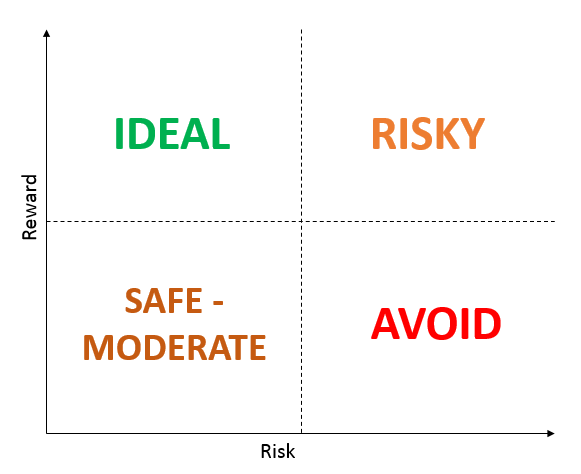

From biscuit tins to bank deposits, every way of parking your hard earned money comes with risks. There exists to be this trade-off between risk and reward and you will have to decide which part of the spectrum you want to be in. Some people prefer a more secure derivative, hence forfeiting a chance to earn higher returns; some prefer a riskier derivative, exchanging security for higher returns.

What about YOUR risk appetite then? Are you risk adverse, or are you a risk taker?

Sign up for our mailing list now! Get notified with the latest articles, free webinars and more.

What is your investment objective?

Prior to any sound decisions you make, there must be an objective that you want to achieve. Same goes for your investment decisions.

However, before fixing your objective, it is important to bear two things in mind.

Firstly, please refrain from crafting your investment objective based on popular sentiments. For example, a common market rhetoric would be “Let’s go for REITS, they offer attractive dividends!” Due to this mainstream opinion, you start focusing on the REITS sector when in actual fact, you may already be too late into the game. Secondly, your investment objective should not be a generic one that goes along the line of “I want to make money”. This is basically an objective that can be applied to anyone, it doesn’t say anything about what YOU are really looking for out of an investment.

Below are four more common investment objectives that you can consider for yourself.

1. Capital Preservation

This is definitely one of the most conservative objectives. It serves to just protect your funds, investing your money in instruments that promise a return of principal. Of course, the downside will be the lower returns you receive at the end of the day.

Examples: Certain insurance/endowment plans, bank deposits, Bond Funds

2. A Secondary Income

Singaporeans love buying properties as a mean of collecting rentals to supplement their primary source of income. This probably also explains why since 2009 to July 2018, the government has implemented 9 rounds of cooling measures to curb the high demand of property investments.

For those who are looking for an alternative to property investments, they can turn to dividend-paying stocks, akin to the idea of rental income.

Examples: REITS, Dividend paying stocks

3. Speculation

This is for people who thrive on volatility. Speculators often get in and out of trades quickly to strive for quick profits. The more volatile a counter is, the more tempted they would be to jump into the stock.

They may not know much about the fundamentals of the company, often only using technical analysis to price their entry and exit points.

Examples: Commodities, Currencies, Margin products.

4. Capital Appreciation

Contrary to speculators, investors who are concerned with capital appreciation are not affected by short term volatility. They are focused on long term growth, often basing their investment decisions on the fundamentals on the company.

One such investor is the renowned Warren Buffett who is famous for his “buy and hold” strategy, diving deep into the fundamentals of a company to guide his investment decisions.

Examples: Real Estate, Art pieces, Stocks

Source: Google image

After a quick discussion about the four most common investment objectives, I hope you would now have a clearer idea on why you have decided to embark on this route of financial investments.

What is your time horizon?

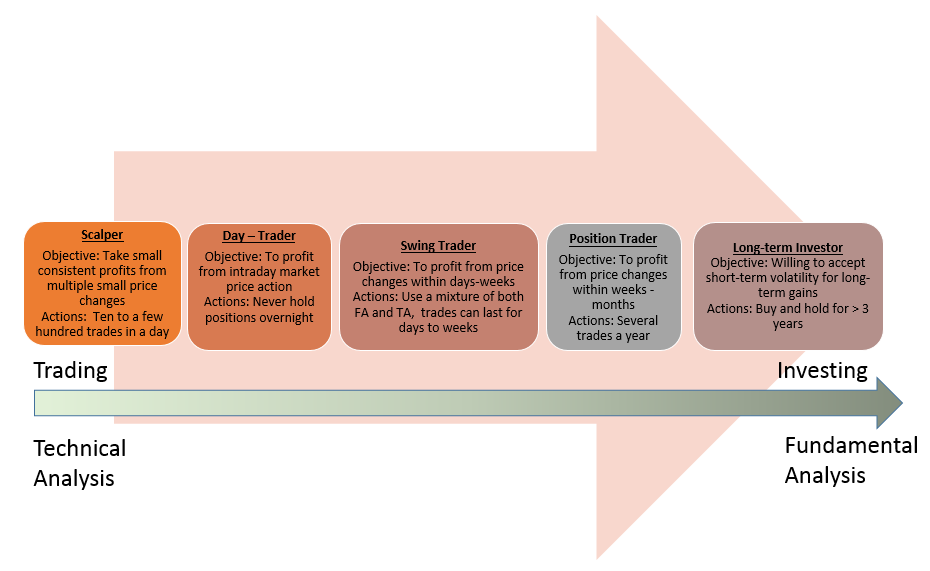

Are you looking to adopt a “buy and hold” or a “fast game” strategy? For the former strategy, would you be willing to lock up your cash for years in the stock market? Will there be a time when you foresee yourself needing that cash for emergency purposes? For the latter strategy, would you be confident enough to time the market accurately and to make use of short term volatility to profit from your trades?

If you identify yourself as a trader more than an investor, then CFD might be your go-to product to make the most of your resources. (There are FREE seminars which you can attend to learn more about this derivative product!)

To end this post, I shall leave you with the quote,

Knowing is half the battle. – G.I .Joe

Choose the right product and you will have a good start to beat the market!

Sign up for our mailing list now! Get notified with the latest articles, free webinars and more.

Leave a comment

More Articles

Understanding Contracts for Difference (CFD)

“What is CFD?” might be a question that has popped up into the minds of those that just recently got acquainted with the concept of investments.

Beating the Efficient Market Hypothesis

If you have any sort of finance background, you will probably have heard of the Efficient Market Hypothesis (EMH). It’s an economic theory that states that all available information are reflected in the prices..

Top 10 common trading mistakes [with solutions!]

Stay tuned as we list out the Top 10 trading mistakes which we observed from our clients. Why this is so important? Because such events will happen again and Will YOU be able to benefit from it?

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.