3 Hong Kong Index CFDs: Features and Trading Strategies (Part 2)

Kah Chee, Assistant Manager, Dealing

Kah Chee graduated from Nanyang Technological University with a Bachelor’s Degree in Accounting. With more than 10 years of experience as a full time, professional investor and trader specialising in the Hong Kong and US markets, he employs fundamental and technical analyses with experience in a multitude of financial instruments.

Mike Ong, Assistant Manager, Dealing

Mike is a member of the largest dealing team that specialises in Equities, ETFs, CFDs & Bonds, and manages >50,000 client accounts in Phillip Securities. He believes in investing long-term for passive income and evaluates stocks using fundamentals.

He is currently the chief editor of the HQ education series that aims to equip clients with tools and skill sets to make better investing and trading decisions.

At a glance:

- China is facing immense political and economic pressures from many countries. US-listed Chinese companies face threats of delisting, a ban from doing business with American companies, or getting blacklisted from American investments. Chinese companies might think twice on listing on US Exchanges.

- China’s 14thFive-Year Plan focuses on self-strengthening, socio-economic development and innovation. In line with this, HKEX recently raised its HSI constituent cap to 100 stocks in order to attract more listings by Chinese companies.

- If you are looking to gain exposure to China, this is the perfect time to enter markets via our 3 new Hong Kong Index CFDs. They have been designed to help you ride Chinese markets and the China tech wave with ease!

- In the first part of our series, we explained the popularity of and headwinds for Chinese equities, as well as the challenges faced by foreign investors in picking Chinese stocks, especially from the tech sector.

Check out our part 1 article:

https://www.phillipcfd.com/3-hong-kong-index-cfds-ride-the-chinese-tech-wave-part-1/

In this second part, we cover the state of China’s economy.

In 2001, China officially joined the World Trade Organization (WTO). [1] In the 20 years since, its GDP per capita has swollen from US$1,053.11 to US$10,500.40 [2] . Some 800mn people have been lifted out of poverty. Access to health, education and other services has vastly improved. [3] China is currently the second-largest economy in the world, behind the US. [4]

Being a socialist economy has allowed China to combine its private sector with its state sector. This gives China a huge advantage over the other countries, which can only depend on their private sectors. Since 1953, China’s central government has been mapping out five-year plans for the country. These outline a series of social and economic development initiatives for the future development of its economy.

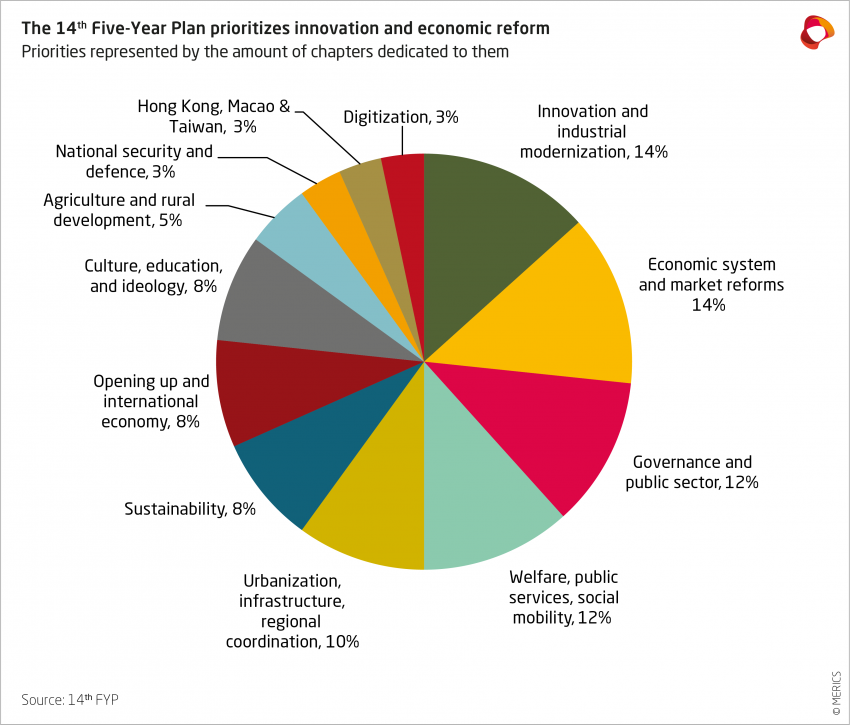

China’s current 14th Five-Year Plan (2021-2025) aims to:

- Strengthen its economy and consolidate its social development

- Cut down its reliance on foreign technology and imported resources

- Double down on its existing plans for industrial modernisation and technological innovation

- Work towards a green economy

Figure 2: China 14th Five-Year Plan

As China grows stronger, it will likely run into more international pressure, especially from the US. Their relations have already deteriorated in recent years. The US has been adding Chinese companies to its economic blacklist and banning investments in these companies. This has created jitters about investing in Chinese companies.

More recently, Chinese regulators added fuel to the fire by cracking down on various sectors, including its tech and education sectors. This has triggered a flight from the Chinese market by global investors.

Is China killing its own economy?

With rapid economic growth comes a widening of wealth and income gaps in China. In China’s 14th Five-Year Plan, policymakers feel the need to ensure social fairness and justice. Instead of chasing after more rapid growth, they are focusing on sustainable and healthy economic and social development.

President Xi Jinping still believes it is ‘completely possible’ for China to double the size of its economy, as well as per capita income, by 2035. [6] China wants to focus on its domestic economy in its next Five-Year Plan to counter a more hostile world. To this end, it will promote high-quality development, satisfy its people’s expectations for a high-quality life and achieve sci-tech self-reliance at a higher level.

Can China overtake the US as the No. 1 superpower?

Overview of our latest Hong Kong Index CFDs

For investors and traders who do not have the time to research on individual Chinese equities listed on the HKEX, we have launched 3 new Hong Kong Index CFDs on POEMS!

These new index CFDs have been handcrafted from benchmark Hong Kong stock indices. They offer diversification across sectors in the Chinese economy to suit your risk appetite. They allow you to benefit from opportunities that can still be unearthed from the market!

Features of our 3 new Hong Kong Index CFDs

|

Contract Specifications |

Hong Kong Tech Index HKD10 CFD |

H-Shares Index HKD1 CFD |

Hong Kong Index HKD1 CFD |

|

Related Cash Index |

Hang Seng Tech Index (HSTECH) |

Hang Seng China Enterprises Index (HSCEI) |

Hang Seng Index (HSI) |

|

Value of 1 Index CFD Point |

HK$10 |

HK$1 |

HK$1 |

|

Target Spreads (Points)* |

11 |

8 |

8 |

|

Margin Requirement |

5% |

5% |

5% |

|

Market Trading Hours |

09:16 – 12:00 13:00 – 16:29 |

09:16 – 12:00 13:00 – 16:29 17:16 – 02:45 |

09:16 – 12:00 13:00 – 16:29 17:16 – 02:45 |

*Spreads are subject to variation, especially in volatile market conditions and may widen during out-of-trading hours.

Source: POEMS, hsi.com.hk & hkex.com.hk

Highlights

- First Hong Kong Tech Index CFD in the market

- No management fees and stamp duties

- Extended trading hours for H-shares and Hong Kong Index CFDs

- Trade both directions of the market, go long or short

The 3 new Index CFDs have contract sizes starting from HK$1 per point. They are part of our ultimate goal to provide you with accessible products in small contract sizes.

Performance, fundamentals and correlations of the related cash indices

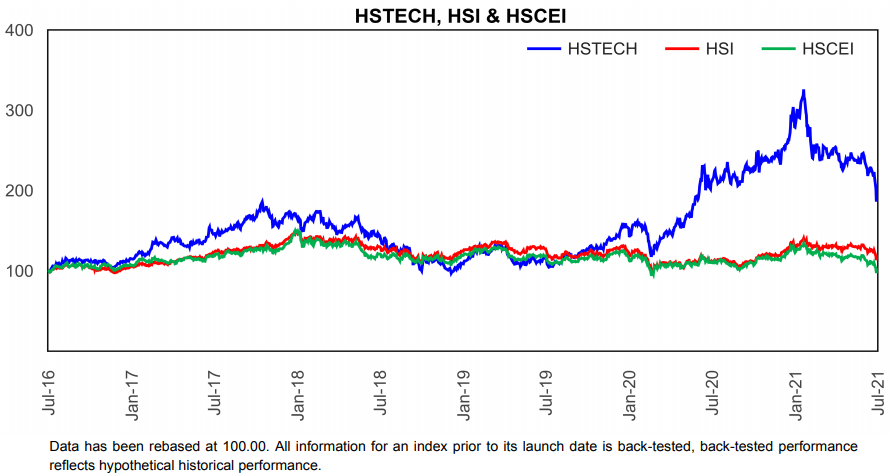

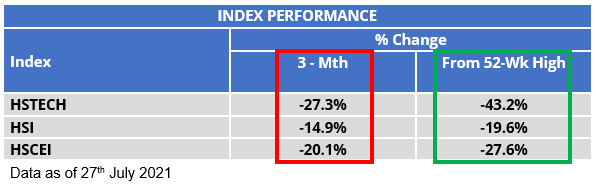

Figure 3: Data as of 30th July 2021 – Source: hsi.com.hk

Figure 4: Data as of 30th July 2021 – Source: hsi.com.hk

Figure 5: POEMS

How to choose

The three indices have varying degrees of volatility, are highly correlated and seem to converge towards one another over a longer time horizon.

Investors with different time horizons may capitalise on these skews by studying the indices’ relative price performances, volatility and correlations to identify trading opportunities.

Potential trading strategies

Varying degrees of pullbacks and corrections in the related cash indices are good illustrations of regressions to means, with the HSTECH Index correcting more due to its bigger run-up in the last five years.

Short-term traders looking at 3-month performance and correlation data of the underlying indices may consider a pair trade of going long on the Hong Kong Tech Index CFD (-27.3%) and short on the Hong Kong Index CFD (-14.9%).

Longer-term traders looking at 3-year data may prefer pairing short positions on the Hong Kong Tech Index CFD (+44.69%) with long positions on the Hong Kong Index CFD (-9.17%).

Savvy traders and investors can deploy such long-short pair trading strategies to benefit from divergences with diversified risks.

- Fundamentals

Value investors looking at the high correlation between the HSCEI and HSI may feel it is a good time to invest in the H-shares Index CFD, with its underlying index’s higher dividend yields and lower P/Es.

More aggressive investors might take a short position on the Hong Kong Tech Index CFD based on its underlying index’s much higher valuation than the other two indices.

- Thematic approach

Based on their underlying cash indices, the three new index CFDs are relatively correlated with one another. They have overlapping constituents, yet are more highly weighted on their own geographical, industrial and sectoral themes. Savvy investors and traders can own a diversified portfolio of the three indices to lower their risks, while making short-term strategic trades based on their view of market-moving developments. An example would be taking short positions on the Hong Kong Tech Index CFD while maintaining long exposure to the Hong Kong Index CFD amid the Chinese government’s crackdown on the technology sector.

If you are looking to gain exposure to China, this is the perfect time to enter markets via our 3 new Hong Kong Index CFDs. They have been designed to help you ride Chinese markets and the China tech wave with ease! For more information, visit our website or drop us an email at cfd@phillip.com.sg.

If you do not have a POEMS account, you may visit this link or scan the QR code below to open one with us today!

Trade on our award-wining suite of POEMS Platform. Open a CFD Account now!

References

More Articles

The Ultimate Guide to Trading and Investing in Stocks Listed in HKEX

Fun fact: Did you know? The Hong Kong Stock Exchange finished 2020 as the second-biggest IPO market globally! Read our latest article to find out more!

Can Value Still Be Found in Alibaba Group Holding?

Can Value still be found in Alibaba Group Holding? Read our article to find out more!

Hang Seng Index's Biggest Revamp in 51-Year- History: Winners & Losers

Who are the potential winners and losers for the revamp of the Hang Seng Index? Read on our article to find out more!

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore (MAS).